Emerging tech and cautious optimism: Real Estate Sector Outlook

HLB Survey of Business Leaders 2024

From inflation to geopolitical tensions and energy crisis, today's business environment is fraught with uncertainties. While inflation appears to be easing, recent trade disruptions stemming from conflict in the Middle East introduce a new layer of unpredictability.

Our annual HLB Survey of Business Leaders offers valuable insights into this evolving global business landscape. Recent findings indicate that despite enduring years of elevated risks, businesses now embrace uncertainty as the norm. As a result, leaders demonstrate heightened optimism, with 85% expressing confidence in revenue growth—a peak not seen in five years since we started the survey.

In this article, we dive into the survey’s findings from the Real Estate & Construction (RE&C) sector to unveil the unique challenges and opportunities facing this industry amidst a turbulent business landscape.

Embracing uncertainty with confidence

It appears that RE&C businesses have accepted heightened risk and uncertainty as an enduring reality.

Almost half of executives in the RE&C industry (48%) expect global growth to stagnate in 2024. Still, a significant share (35%) express a more optimistic outlook, believing the global economy is rebounding. This contrasts sharply with 2020, the first year of our survey, when merely 6% shared such positivity.

Reflecting this positive sentiment, a striking 85% express confidence in their own companies' ability to grow revenue in 2024, with a quarter displaying very high levels of confidence.

Evolving risk landscape: something old, something new

While businesses adapt to an ever-changing risk landscape, the environment remains challenging and uncertain, with risks ranging from economic uncertainties caused by inflation and interest rate changes to international conflicts and sudden increases in resource costs.

Among business leaders, economic uncertainty tops concerns for 75% of respondents, followed by inflation (73%), and rising interest rates (70%). Geopolitical risks and resource costs, which affect construction expenses globally, are significant concerns for 60% of respondents.

For the RE&C industry, the rise in interest rates is especially worrying. A larger proportion of the sector's leaders, 30% of respondents, express being 'very concerned' about rising interest rates, compared to other sectors where only 21% share the same concern.

While the share of business leaders expressing concerns about changing regulations has decreased from 71% to 42% over the past five years, new risks are on the horizon. For example, the proportion of executives citing concern over environmental risks surged from 32% to 50%, and those concerned about cyber risks spiked from 40% to 68%.

Adapting amid political and trade challenges

To overcome these economic, political and trade uncertainties, over a third of business leaders surveyed (43%) have adopted alternative, more sustainable energy sources to enhance environmental responsibility and long-term business viability.

A similar portion (45%) anticipates that shifts in trade agreements will create new business opportunities. At the same time RE&C leaders are more likely to be focusing closer to home with over half (55%) adjusting their sourcing strategies compared to 49% of respondents globally.

RE&C Priorities for 2024

Our annual survey of RE&C business leaders reveals that operational efficiency improvement tops their 2024 agenda, cited by 65% of respondents, followed by cost reduction (51%), and strategic reviews (46%).

Leaders prioritise addressing weak spots like cost management (39%), risk management (32%), and operational effectiveness (31%) while remaining cautiously optimistic about embracing innovation and new technologies to drive productivity and creativity.

Cautious adoption of new technologies

When it comes to embracing new technologies, the RE&C sector diverges from global trends, with leaders in the sector being more cautious compared to their global peers. Nearly half of them (47%) cite short-term priorities or sudden market disruptions as barriers to new technology investments for their businesses.

Despite lagging behind global peers in prioritising tech adoption (37% vs 60%), its potential benefits are acknowledged, though not to the same extent as in other sectors. The survey reveals that a slight majority of respondents in the sector (51%) believe technological advancements will help address future cross-border business challenges. In contrast, 63% of business leaders from our general sample share that view. However, this difference might be due to the sector's national focus, leading RE&C leaders to prioritise local concerns over cross-border issues, unlike some of their peers.

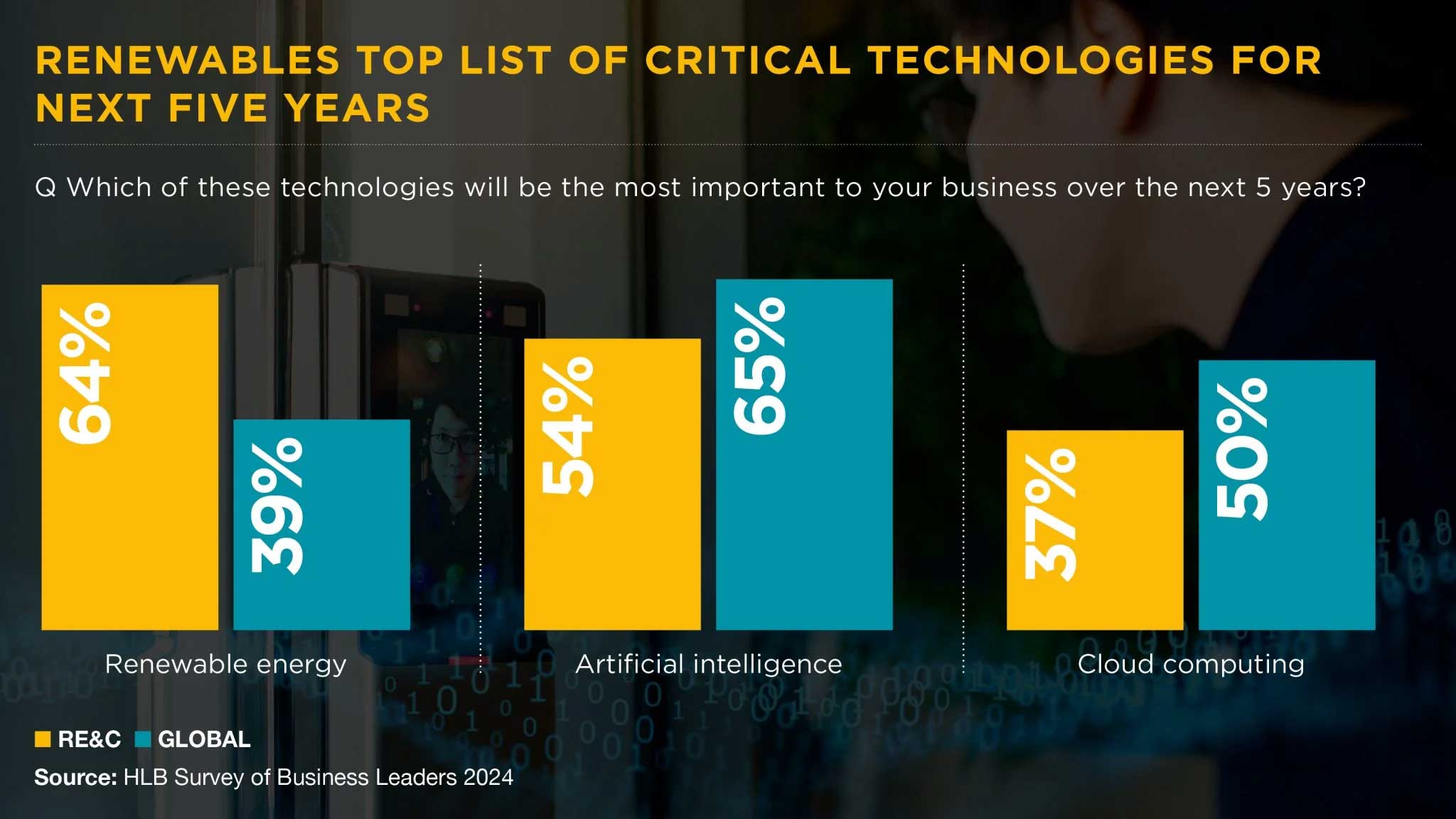

Top technologies for the RE&C sector

While 41% of the sector's leaders are willing to take on more risk in investing in new technologies, many remain sceptical about their benefits.

Only 57% of RE&C leaders agree that emerging technologies, including AI and machine learning, are crucial for driving innovation, creativity, and productivity for the business, a notable difference from 68% in our global sample.

Another idiosyncrasy of the sector is at play here with higher value being placed on new technologies beyond digital advancements.

Renewable energy stands out as particularly essential, with 64% of respondents emphasising its significance compared to 39% in the global sample. AI ranks as the second most important technology for future success, cited by 54%. It is followed by cloud computing which stands at 37% as a vital infrastructure for other technologies like AI, robotics, and IoT.

AI Resistance: Barriers and potential in the RE&C Sector

Although it's ranked as the second most crucial technology, there appears to be some resistance to AI among sector leaders, indicating a need for them to fully embrace the concept.

A significant portion of RE&C respondents, almost a quarter, approach AI cautiously, fearing that potential risks outweigh benefits. Alarmingly, 37% have not yet begun their AI journey. Although more than half have identified AI use cases, 43% have not yet started adoption efforts.

The primary barrier to AI adoption in the RE&C sector is a lack of digital transformation skills, as identified by 43% of respondents. In efforts to enhance digital skills, RE&C leaders often emphasise the need for trainers to be well-versed in the sector's nuances and to possess expertise not only in AI's capabilities but also in industry-specific matters.

A lack of AI use-case examples is another significant barrier to AI integration, as reported by 38% of respondents. "I just can't see how it would benefit us," is the view of a European executive interviewed in the survey—a sentiment echoed by many of their peers.

Given these findings, it is not surprising that the applications of AI in the sector are not as advanced in their AI adoption journey. Almost a third of sector respondents use it mainly for document processing tasks, which outstrips test/data mining (21%), content generation (20%), R&D (18%), process automation (15%), and quality control (15%).

However, there are signs of a shifting landscape, with examples of more sophisticated deployment of this novel technology emerging. For example, one industry innovator sees AI assisting construction professionals in decision-making through data analysis, simulations, and predictive modelling, improving project planning, resource allocation, risk management, and cost optimization.

Cautious optimism in the face of growing challenges

Despite ongoing uncertainties, there is increasing optimism among RE&C leaders, with many expressing confidence in revenue growth for 2024. RE&C businesses have embraced the heightened risk environment as a constant factor, leading them to prioritise operational efficiency and cost reduction. However, challenges persist, particularly in the cautious approach towards technological adoption compared to global trends.

How HLB can help

Through strategic guidance and specialised services, HLB International seeks to empower RE&C leaders to optimise operations, mitigate risks, and capitalise on emerging opportunities in an evolving business landscape. Our Real Estate team specialises in providing industry-specific insights and solutions to address the unique challenges faced by RE&C leaders. Get in touch, our team would be delighted to help progress your plans for sustainable growth in a rapidly changing environment.