North America: Preparing for an AI-led growth cycle

HLB Survey of Business Leaders 2024

North American business leaders are confident and resilient

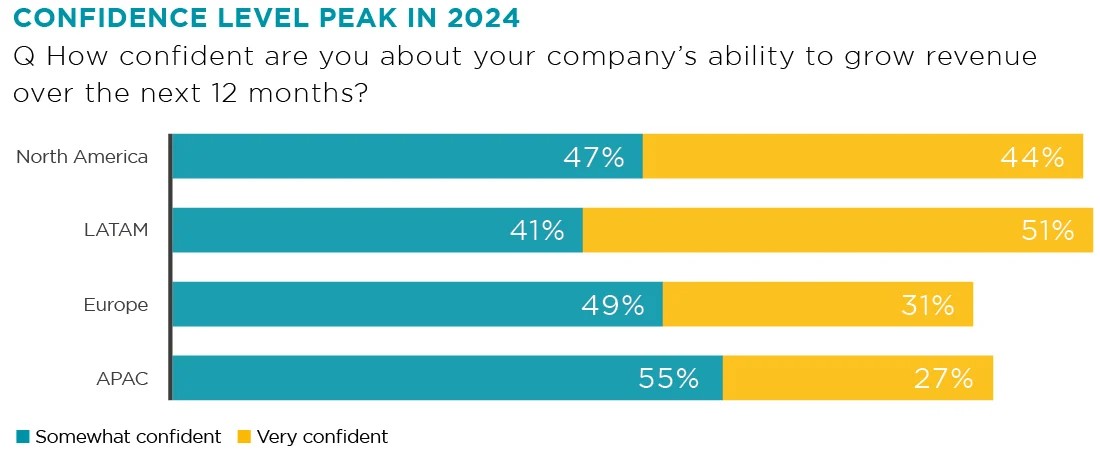

North American leaders are optimistic after a year of stronger-than expected macro-performance. 91% are confident in their ability to grow revenues this year — the most positive sentiment globally. Only 22% of respondents expressed the highest confidence level last year, compared with 44% this year.

The US recorded a 2.8% real GDP growth in 2023, while Canada’s was 1.3%. For 2024, a more modest expansion is expected at 0.7% and 0.9%, respectively. Positive tailwinds for business leaders include a strong labour market, labour cost compression, and decelerating inflation. High interest rates continue to constrain economic activity but also alleviate inflationary pressures as both countries aim to reach a 2% target in 2024.

Confidence in the global economic rebound increased from 25% in 2023 to 42% this year. Half as many North American leaders expect a slowdown in economic growth compared to last year despite ongoing stressors.

Risks to growth persist with over half of the leaders concerned with seven risk vectors. Inflation (74%), geopolitical risks (72%), and cybersecurity issues (71%) are the top three stressors. High levels of concern over rising resource costs, lingering economic uncertainty, and rising interest rates are, to an extent, reinforced by the top risk factors.

The Federal Reserve has adopted a ‘higher for longer’ interest rate approach to control headline inflation. The hiking cycle appears to be over with interest rates likely to hold at 5.25%- 5.5% until mid-2024. Under tight fiscal measures, inflation has been decelerating, with rates hovering between 3% and 4% through mid-2023 and early 2024. Morningstar expects a further drop to the Fed’s 2% target rate later in 2024 and an average of 1.9% from 2024 to 2028.

A dual focs for 2024: Business optimisation and revenue growth

In response to ongoing market volatility, North American leaders aim to balance optimisation against growth. Increasing operational efficiencies is a top priority for the next 12 months, followed by new technology adoption, new product and service launches, and strategy reviews.

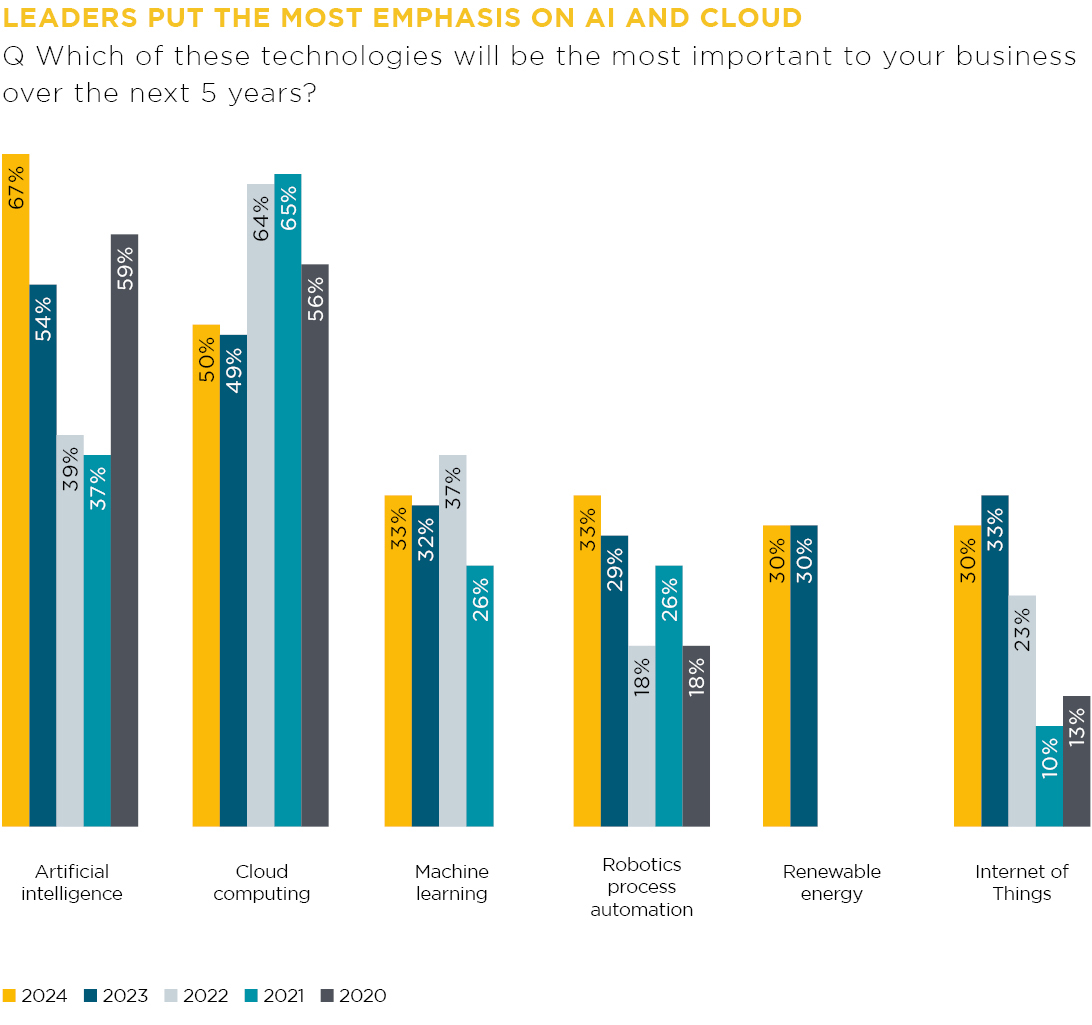

Cloud continues to maintain a second position for the second year in a row. Peak interest levels in cloud computing were in 2021-2022, likely indicating the company’s push for the adoption of digital business models. The importance of robotic process automation (RPA) saw the second sharpest increase compared to last year, up 10%. RPA has proven to be an affordable and effective technology for business process automation. Globally, companies now have 77 RPA processes in production, while 25% of enterprises have over 250 process automations in their estate.

Business leaders in North America view technology adoption as a critical lever for agility and growth. 71% agree that emerging technologies (including AI and machine learning) are key to driving innovation, creativity, and productivity for the business.

ChatGPT amassed millions of leisure and business users within months, handling tasks from meal planning to consumer sentiment analysis. Harvard Business School and The Wharton School researchers estimated that generative AI models

improve highly skilled workforce performance by 40% on business tasks like preparing a new product presentation. However, the study also showed that some employees may rely fully on AI recommendations, leading to suboptimal

outcomes.

Gen AI (and other emerging technologies) can undeniably help leaders address their top weaknesses in operational efficiency (38%) and cost management (38%). However, technology is a tool that still requires skilful operators. AI may

not match human cognitive effort and expertise in analytical judgments and strategic decisions. What the technology does well is streamline menial and manual workflow steps, freeing human talent for strategic tasks requiring logical

reasoning and creativity.

In the context of emerging technologies and AI, over half are prepared to take on more risk, given the potential benefits of success. “Artificial intelligence technologies — generative AI, in particular — have proliferated around the world and

in countless capacities over the last year. They’ve put seemingly infinite possibilities for efficiencies and easy execution at everyone’s fingertips — not just those of computer programmers, engineers, and the like,” says Stacie Kwaiser, Chief Executive Officer, Rehmann (HLB USA).

“On the other side of the coin, however, AI’s accessibility also makes the work of threat actors easier and more efficient,

which has compelled all of us to adopt ever-better technologies to protect our organizations”. AI adoption exposes businesses to novel threats: attacks against AI models in production and AI-enabled exploits. Both can carry substantial

operational risks and require better cyber defence mechanisms. 34% of business leaders already flagged ‘cybersecurity’ as a weakness area to address this year, up by 9% compared to 2023.

How North America is entering the era of AI-led growth

Emerging technologies are changing how companies build new products. Some embed AI models into existing products to unlock new capabilities. The Royal Bank of Canada (RBC) has operated the Borealis AI Research Institute since 2016, working on R&D and commercialised AI applications in finance.

RBC ranked in the top three for AI maturity among 50 global financial institutions in the Evident AI Index for the second year in a row, with JPMorgan Chase and Capital One taking the first and second positions, respectively. Others are using the technology to improve how they approach product design, manufacturing, sales, or post-customer support.

General Motors (GM) uses generative artificial intelligence algorithms to create more durable parts and optimise vehicle design. Using the software, GM engineers improved the design of a seat bracket, making it 40% lighter and 20% stronger.

Procter & Gamble (P&G) relies on combining industrial automation technologies and AI algorithms to improve lead time for new products. After a series of successful pilots, P&G plans to digitise and integrate from over 100 manufacturing facilities. Then, leverage AI to support operating and product development decisions.

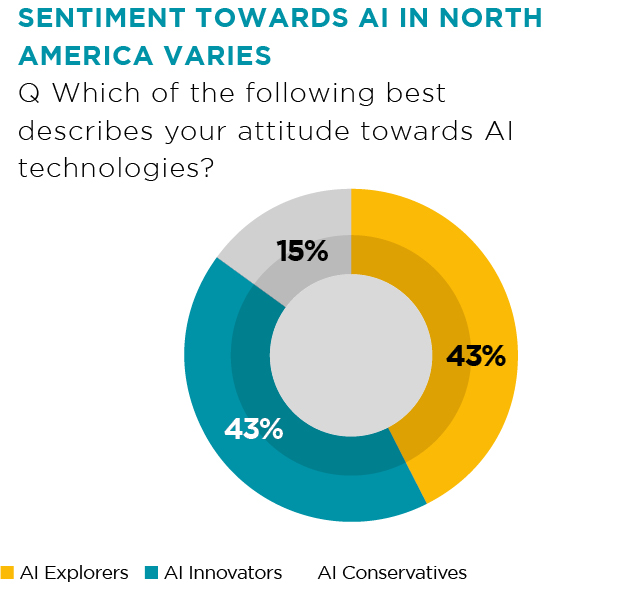

Among North American respondents, 43% are eager to use or have already adopted AI. Of these, 18% are widely using AI for a competitive advantage, twice the rate in APAC and Europe. “We are leading with AI and have done a partnership with NVIDIA Corp for developing LLM,” a leader from the technology sector shared.

An equal proportion (43%) are willing to try AI technologies for the right business case. Yet, 13% are also cautious about deploying AI, considering that the risks outweigh the benefits, while 2% are averse and doubt the impact. A degree of realism, however, is necessary when evaluating maturity levels.

“In many cases, the rapid advancement of technology is outpacing the actual utilization and understanding of what is possible,” says Dayton Benway, Managing Principal, Baker Newman Noyes at HLB USA. “In my opinion, technology adoption increases may sometimes be an acknowledgement that companies have been investing in new tech but not the adoption and are now focusing on the adoption phase”.

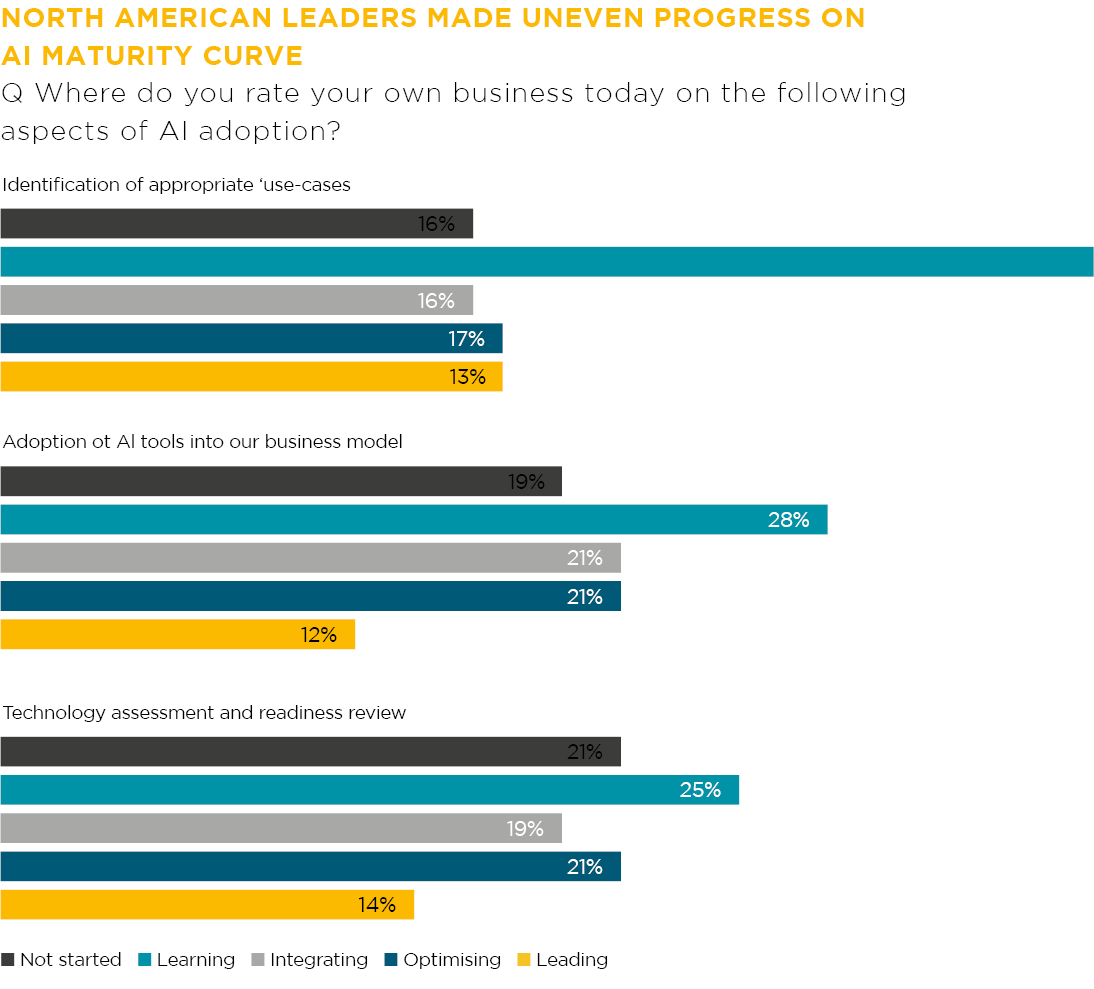

Indeed, North American leaders are at various AI adoption stages: 16% haven’t started, 29% are learning, 21% are integrating AI into business operations, 22% are optimising, and 11% are leading in AI adoption. Over half of the leaders (54%) have completed data quality checks and technology readiness assessments. 46% have also identified the most appropriate use cases, while 37% actively evaluate different options.

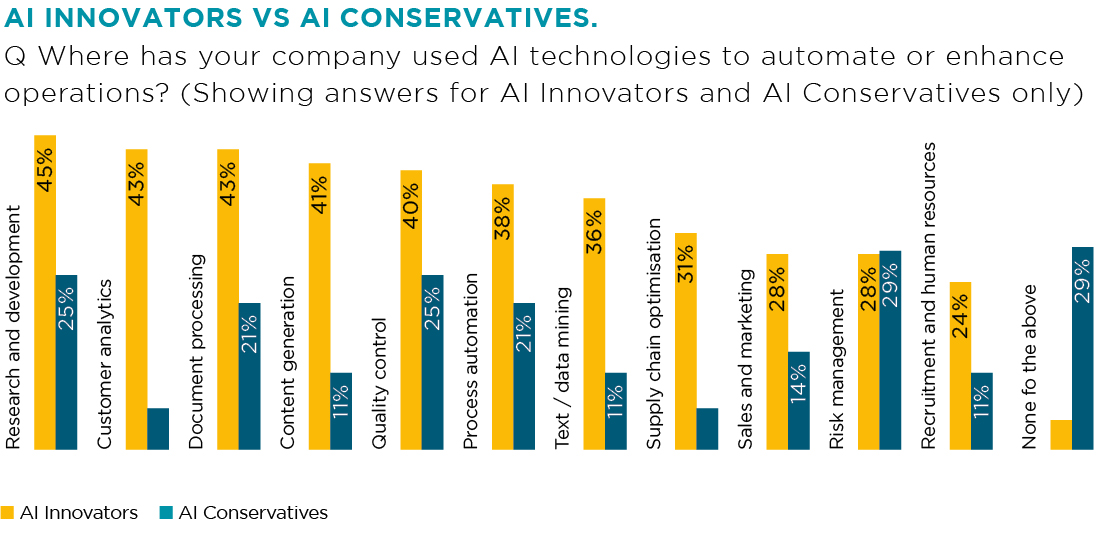

The selection of use cases differs substantially between AI Innovators and AI Conservatives. Companies further on the maturity curve are primarily using AI for R&D activity (45%), customer analytics (43%), and document

processing (43%).

This cohort appears to be gearing up for a new growth cycle as they’re also planning to launch new products to grow this year and review their strategy.

AI Conservatives, understandably, are less likely to use AI in general. 25% haven’t yet explored either of the use cases. While 25% are experimenting with AI for quality control and R&D In terms of growth plans, 43% of AI

Conservatives are relying on organic growth.

Only 39% plan to launch new products or services (not necessarily AI-related) against 64% of AI Innovators.

Barriers to adoption

Areas where leaders made the least progress include AI-specific staff training and technology vendor evaluations. Over 30% haven’t yet started with either. “We need a lot more training, so a company that can educate and bring along our IT team as to how to best use AI technology to enhance business operations,” a CTO at a publicly-listed hospitality company admitted.

A leader from the manufacturing sector also mentioned the need for “better training for our technology staff regarding the implementation of AI tools” as a prerequisite for faster progress.

AI adoption raises a lot of discussions about data ownership. Over half of leaders see data security and privacy concerns as top barriers to AI adoption. AI models can access large training datasets, often containing sensitive information.

When accessible via public interfaces, such models can be prompt-injected with malicious commands to disclose sensitive information. Due to a glitch, paid ChatGPT users’ names, email addresses, and credit card numbers (the last four digits only) became publicly available for a brief period in March 2023.

To secure new AI products, leaders will also need to substantially update their data management practices ensuring that no sensitive data is used for model training purposes to prevent IP, compliance, and licensing risks. New privacy-preserving machine learning and privacy-preserving federated learning are also helping leaders secure publicly accessible models from targeted cyberattacks.

For further insights from the region and advice on how you can capture the most value from AI adoption, click below to download the North American HLB Survey of Business Leaders report in full.